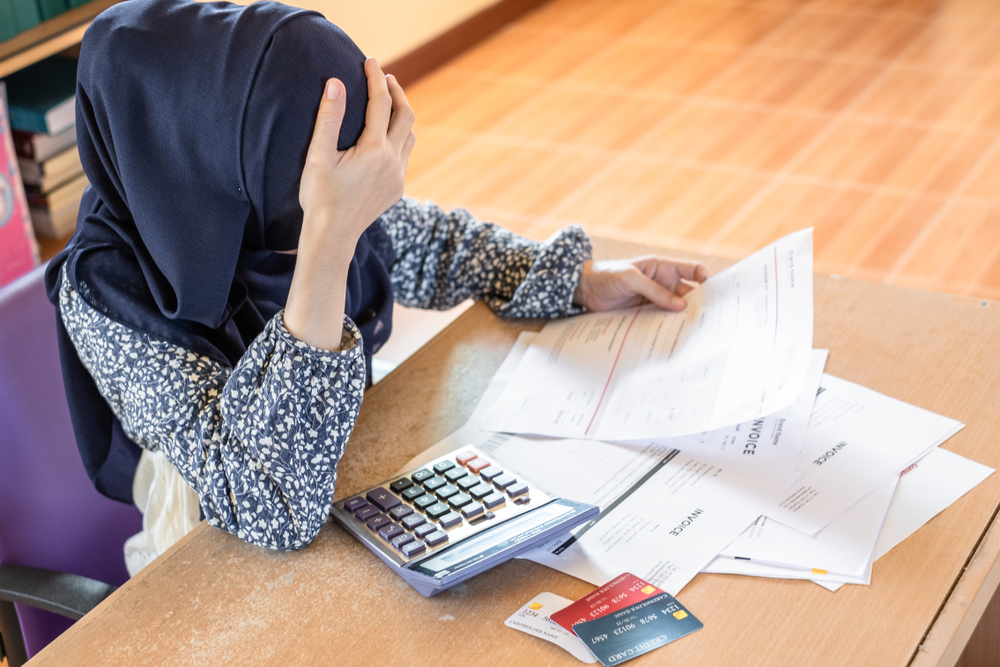

Hey there! Do you ever find yourself stressing over your finances? Are you struggling to make ends meet or worrying about unexpected expenses?

Don’t worry. You are not alone in this. Many of us from all walks of life get stressed about money. It can happen due to many factors, including job loss, debt, unexpected expenses, and lack of financial planning.

Whatever the case, financial stress can impact your overall well-being, including your performance at work. That’s why employers must prioritize financial stress management for their employees.

Now, how can that happen?

It’s simple. Employers need to put more effort into their employees’ managing their finances. It happens when you provide resources and support.

And how does it pay you off as an employer?

You will create a healthier, more productive workplace that benefits everyone – from office helpers and interns to your specialists and team leads.

Healthwire, the leading digital healthcare platform in Pakistan, has taken it upon its shoulders to provide a corporate wellness program for employees. We understand the impact of employee wellness on the success of organizations.

Here’s a sneak peek of Healthwire’s corporate wellness team’s efforts to educate the organizations on employee well-being:

Let’s dive into why financial stress management is a crucial element of the workplace and what employers can do to help their employees.

Table of Contents

What is Financial Stress?

You may not be familiar with this term, but financial stress is real.

It is a pervasive problem that any of us can face, irrespective of income and social status. However, it is particularly challenging for employees who want to and are trying to balance their work and personal lives.

Financial stress can impact many areas of an individual’s life, including work performance and overall well-being.

Now, why do we emphasize financial stress management? What are the effects of financial stress?

That’s because financial stress leads to decreased overall productivity and increased absenteeism from your work responsibilities.

You may wonder how does financial stress affect your health?

It can manifest in physical forms, such as headaches, stomachaches, and fatigue. In severe cases, it can even cause mental health issues, such as anxiety, stress, worry, irritability, and depression.

It can strain your well-being and increase your healthcare costs due to the physical and mental health problems you will face due to financial stress.

Therefore, employers should help employees manage financial stress to ensure they are healthy, happy, and productive.

How to Deal with Financial Stress in the Workplace?

How to overcome financial stress? We will discuss much-needed tips for financial stress management in the workplace!

Provide Financial Education and Resources

You should understand your employees’ level of connecting with the financial perspectives. They may not know much about basic concepts such as budgeting, saving, and investing.

A financial stress education session can help them understand these basic concepts and become financially literate.

It includes workshops, online courses, or one-on-one counseling sessions with financial experts.

Offer Flexible Work Arrangements

When your employees lack flexibility in the workplace, the financial stress can exacerbate. They may feel trapped in their jobs and unable to pursue other opportunities or take time off to attend to personal matters.

How can you help your employees with this?

By offering flexible work arrangements! They can either take remote work for some time or get flexible schedules to save money on transportation and childcare expenses. It can help reduce financial stress and improve their mental health and overall well-being.

Additionally, flexible work arrangements can help employees manage their work-life balance, reducing stress levels in the long run.

Provide Employee Assistance Programs

If you have employees struggling with financial stress, you can introduce an Employee Assitance Program to your workplace.

These programs are a great source of providing confidential counseling and support for many issues, including financial problems. You can offer EAPs as part of their benefits package to ensure your employees have the help they need.

Suggested Read: Major Social Problems in Pakistan.

Encourage Open Communication

If you want to give your employees financial security, provide them with open communication in the workplace. Yes, it’s crucial because employees can feel comfortable discussing their financial concerns with supervisors or HR departments.

As an employer, you can create a workplace environment where employees feel comfortable discussing their issues. You can do this by promoting open communication and providing resources to help them manage their financial stress.

Read more about how mental fitness and employee wellness co-exist.

Offer Financial Wellness Programs

Employers can offer financial wellness programs to help their employees manage financial stress.

These programs can include financial planning, debt management, and investment advice.

By offering these programs, you can also help employees better understand their finances and make better financial decisions.

Provide Health and Wellness Programs

As we discussed before, financial stress can lead to many physical and health problems, further exacerbating financial stress and overload on money.

You can offer ‘Health and Wellness Programs’ to help your employees manage stress and maintain a healthy lifestyle.

These programs can include yoga classes, meditation sessions, or gym memberships. Furthermore, you can even add a gym and relaxation center in a quiet workplace corner.

Read more about the health benefits of yoga.

Consider Offering Financial Incentives

Lastly, there are financial incentives that you, as an employer, can consider for the employees. These incentives can help your employees take care of their financial stress and may include the following:

- Retirement plans with matching contributions

- Financial education and counseling services

- Health insurance plans with affordable premiums and deductibles

- Flexible spending accounts or health savings accounts for medical expenses

- Bonuses, profit-sharing, or stock options programs

Moreover, these incentives can help employees better manage their finances, reduce debt and improve their overall financial well-being.

Need of the Hour – Dealing with Financial Stress of Employees!

If you want your workplace to thrive and succeed, dealing with financial stress that keeps your employees up at night is essential because it can impact their work performance and overall well-being.

Money motivates a lot, so employers should take steps to help employees manage financial stress by providing financial education and resources, flexible work arrangements, and employee assistance programs.

By taking these steps, employers can create a healthier, more productive workplace that benefits employees and the organization.